Home loan tax saving calculator 2020

Ad Compare The Best Mortgage Rates. Tax Saving Calculator can be used to get an estimate of the tax that can be saved by claiming the deductions available as per the applicable laws.

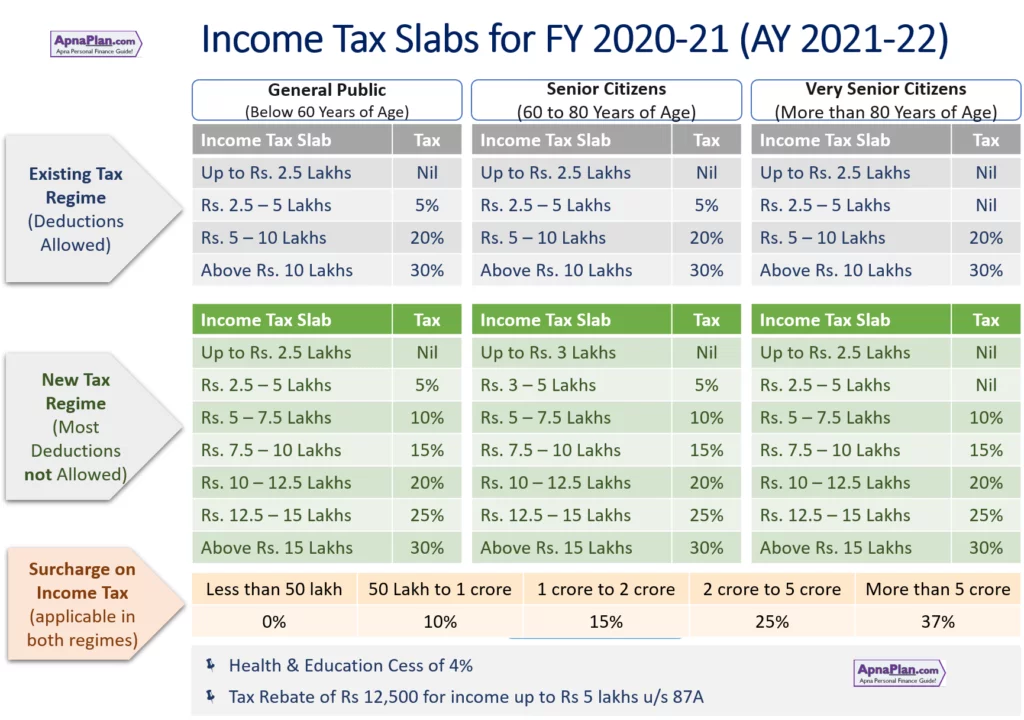

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Interest Accrued on Home Loans.

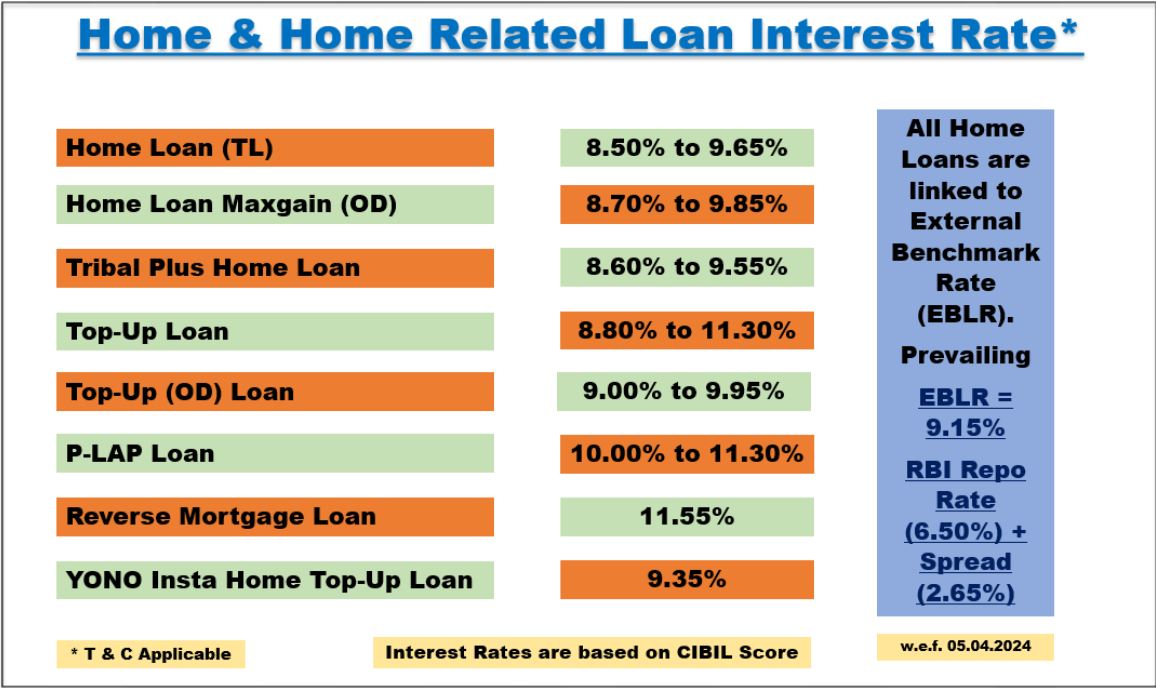

. You may claim deductions in your income tax against principal and interest payments that you make towards repayment of your. MaxGain Home Loan Calculator. An individual is given extra tax benefit amounting to Rs50000- for interest paid on the home.

Home Loan Tax Saving Calculator. Income tax deduction for first time home buyer in India under section 80EE -. Tax Saving Calculator AY 2021-22 2022-23 About this Calculator.

The calculator is simple and has an easy-to. For taxpayers who use married filing separate. Calculate Your Home Loan.

Check tax benefits on home loans under section. Ad Work with One of Our Specialists to Save You More Money Today. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Maxgain Home Loan is an innovative and customer-friendly product enabling the customers to earn optimal yield on their savings by reducing interest. 150000 on the principal repayment of a home loan. Top-Rated Mortgages for 2022.

You can use the Home Loan Tax Saving Calculator on Bajaj MARKETS to calculate the total tax benefit that you can get on your home loan. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Work with One of Our Specialists to Save You More Money Today.

This tool estimates your average yearly tax savings on a mortgage loan and calculates your after-tax interest rate on the loan. 200000- Total Deductions from Income chargeable at. As per Section 80C and Section 24B of the Income Tax Act 1964 you could be eligible for tax saving benefits via both the principal and.

How our Tax Saving Calculator can help you. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Under Section 24 you claim up to Rs.

How is tax exemption on Home Loan. Under Section 80C of the Income Tax Act you can claim deductions of up to Rs. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions. Rates are At a 40-year Low. Call 800-236-8866 Monday-Friday 9 am-5 pm.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

How Is Taxable Income Calculated How To Calculate Tax Liability

Sbi Home Loans Nri Home Loan

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Click Here To View The Tax Calculations Income Tax Income Online Taxes

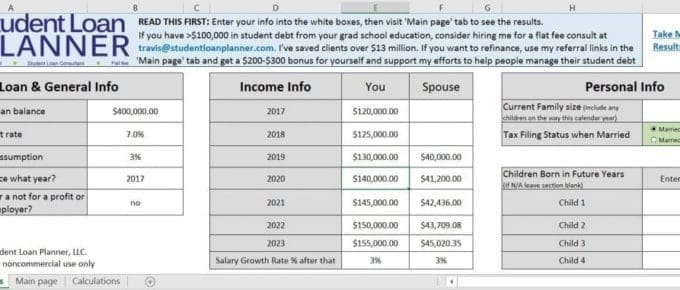

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

How To Claim Tax Benefits On Home Loan Idfc First Bank

Property Tax How To Calculate Local Considerations

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Section 80ee Deduction For Interest On Home Loan Tax2win

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information